Deribit - platform for trading on options and contracts on BTC and ETH

- Details

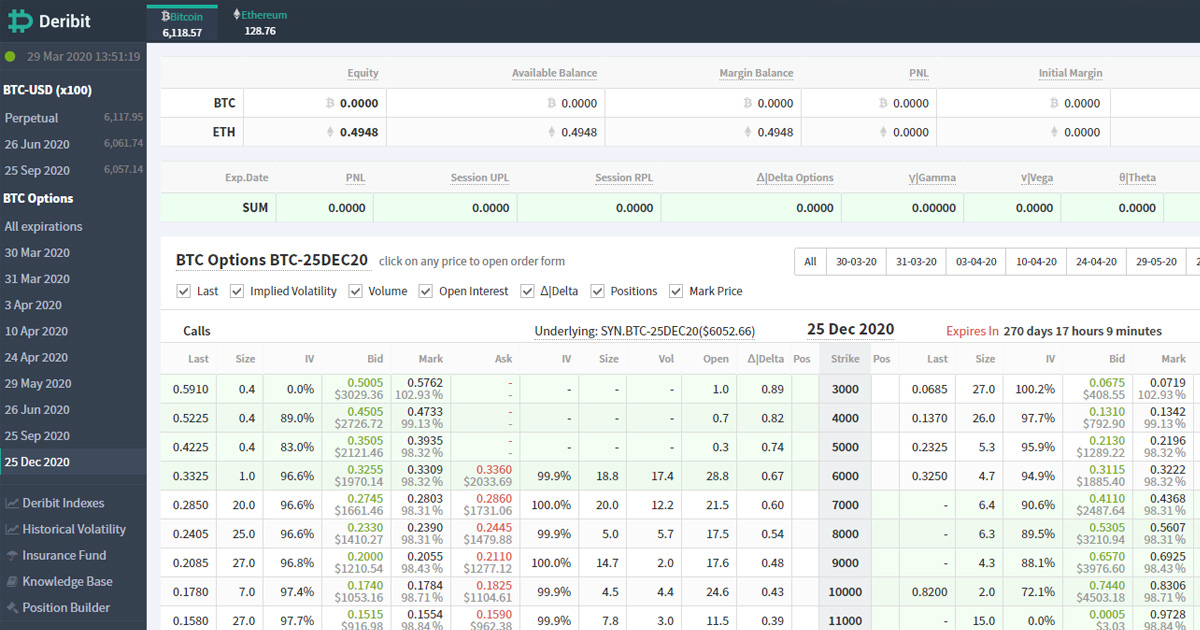

For some time I have been testing the Deribit platform that allows trading on vanilla options and contracts on Bitcoin and Ethereum.

Deribit is currently the most advanced cryptocurrency trading platform of this type.

The platform allows you to trade European type options with 10x leverage. Of course, trading with contracts with 100x leverage is also available. I believe that Deribit is a better alternative to BitMex.

I believe that these types of platforms are intended for advanced users who already have experience in trading options and contracts. It is possible to test the platform for a demo, which I urge you to do!

I trade Ethereum options on the Deribit platform.

I have several years of experience with options from the traditional US market. The Deribit platform is a chance for me to play different scenarios on BTC and ETH.

Options on the Deribit platform are of the European type and settled in cash in a given cryptocurrency. For Bitcoin it is BTC and for Ethereum naturally ETH.

Personally, I would prefer the options to be quoted in a stablecoin, eg USDC, and the settlement was in physical form in the form of a given cryptocurrency! That's what I'm used to from trading stock options. It also has its good points when it comes to the strategy of putting PUT options in order to buy cryptocurrency cheaper and earn a bonus. I have sent my suggestion on this to the platform owners.

The European type of options means that the options cannot be exercised before the expiry date. However, it's worth noting that they can still be traded before they expire. Deribit options are automatically executed upon expiration, so you don't have to worry about how or when to do it.

Options over contracts have many advantages:

- they are resistant to temporary above-average price fluctuations (breaking the stop loss),

- protect against large gaps in price and jump stop poss,

- we have a predetermined risk that we bear,

- Option strategies to play by direction or volatility can be used

If you are interested, I encourage you to test the Deribit platform.

Register for free from the link below to get a 10% discount on commissions:

https://bit.ly/Deribit-Trading-Platform

Not sure what the options are?

I recommend you to watch the introductory video below:

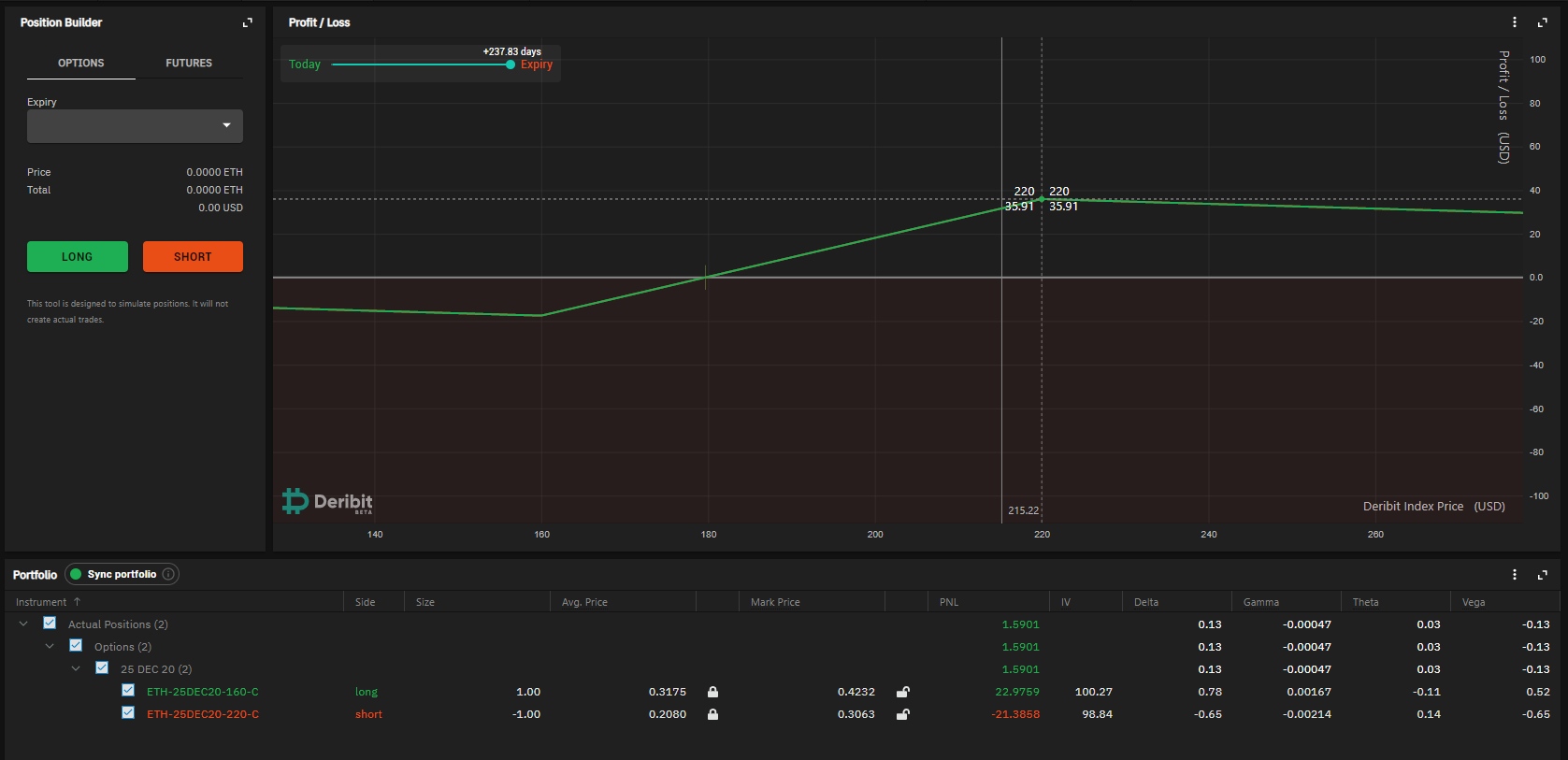

Position Builder is a very useful tool on the platform

It is a tool that allows you to build portfolios and view a portfolio's profit / loss chart. Portfolios can consist of multiple positions for both options and futures and display the profit / loss for the entire portfolio on a friendly chart.

See the video presentation of the Position Builder tool:

It is worth visiting the following sites:

https://www.tradingforaliving.pl/opcje/

https://analytics.skew.com/dashboard/bitcoin-options

UPDATE:

Below I present one of my transactions from 4-04-2020:

This is the Vertical Spread on ETH

Bull CALL Spread (debit)

With an expiration date of December 25, 2020

Markings below

ETH-25DEC20-160-C

ETH-25DEC20-220-C

I was buying a CALL option with a strike of $ 160, for which I paid $ 45

I was selling a CALL option with a $ 220 strike for a $ 30 bonus

My maximum risk is $ 15 and my maximum gross profit is $ 45 if the ETH price is above $ 220 after December 25, 2020.

The profile looks like this:

Important!

In this article, I am not encouraging anyone to invest and I am not recommending anything. I only share my experiences and my opinion.